Get the free 26582012 form - tax ny

Show details

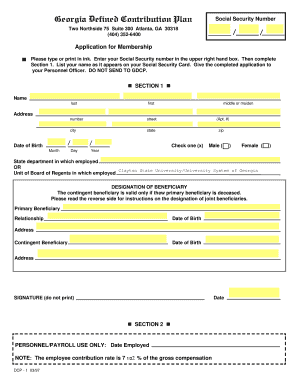

Total estimated tax paid from all and IT 2658 ATT. Contact e-mail address Allocation of estimated tax to nonresident individual partners and shareholders attach Form s IT-2658-ATT if necessary Partner s/shareholder s first name and middle initial Partner s/shareholder s last name Mailing address number and street or rural route see instructions Social security number SSN Apartment number Amount of estimated tax paid on behalf of nonresident...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 26582012 form - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 26582012 form - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 26582012 form - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 26582012 form - tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out 26582012 form - tax

How to fill out 26582012 form:

01

Start by carefully reading the instructions provided with the form to understand the purpose and requirements.

02

Gather all the necessary information and supporting documents needed to complete the form accurately.

03

Begin filling out the form by entering your personal details, such as name, address, date of birth, and contact information.

04

Follow the instructions for each section of the form and provide the requested information accurately and completely.

05

Double-check all the entered information to ensure there are no mistakes or missing details.

06

Review the completed form once again to make sure everything is accurate and complete.

07

Sign and date the form as required.

08

Make copies of the filled-out form and any supporting documents for your records.

09

Submit the completed form and any required documentation as instructed.

Who needs 26582012 form:

01

Individuals who are required to report specific information or complete certain actions as mandated by the 26582012 form.

02

Organizations, businesses, or entities that are mandated by law or regulations to provide the information requested in the 26582012 form.

03

It is important to refer to the instructions or seek guidance from relevant authorities to determine if you specifically need to fill out the 26582012 form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 26582012 form?

The 26582012 form is a tax form used for reporting income and tax obligations.

Who is required to file 26582012 form?

Individuals with a certain level of income or specific types of income may be required to file the 26582012 form.

How to fill out 26582012 form?

To fill out the 26582012 form, you will need to provide information about your income, deductions, and credits. This information can be entered manually or electronically on the form.

What is the purpose of 26582012 form?

The purpose of the 26582012 form is to calculate and report an individual's income tax liability to the tax authorities.

What information must be reported on 26582012 form?

The 26582012 form requires individuals to report their income from various sources, such as employment, investments, and self-employment. It also requires reporting of any deductions or credits that apply to reduce the tax liability.

When is the deadline to file 26582012 form in 2023?

The deadline to file the 26582012 form in 2023 is typically April 15th, unless an extension has been granted by the tax authorities.

What is the penalty for the late filing of 26582012 form?

The penalty for the late filing of the 26582012 form can vary depending on the specific circumstances, but it may be a percentage of the outstanding tax due or a flat fee imposed by the tax authorities.

How can I manage my 26582012 form - tax directly from Gmail?

26582012 form - tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in 26582012 form - tax?

The editing procedure is simple with pdfFiller. Open your 26582012 form - tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my 26582012 form - tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 26582012 form - tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your 26582012 form - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.